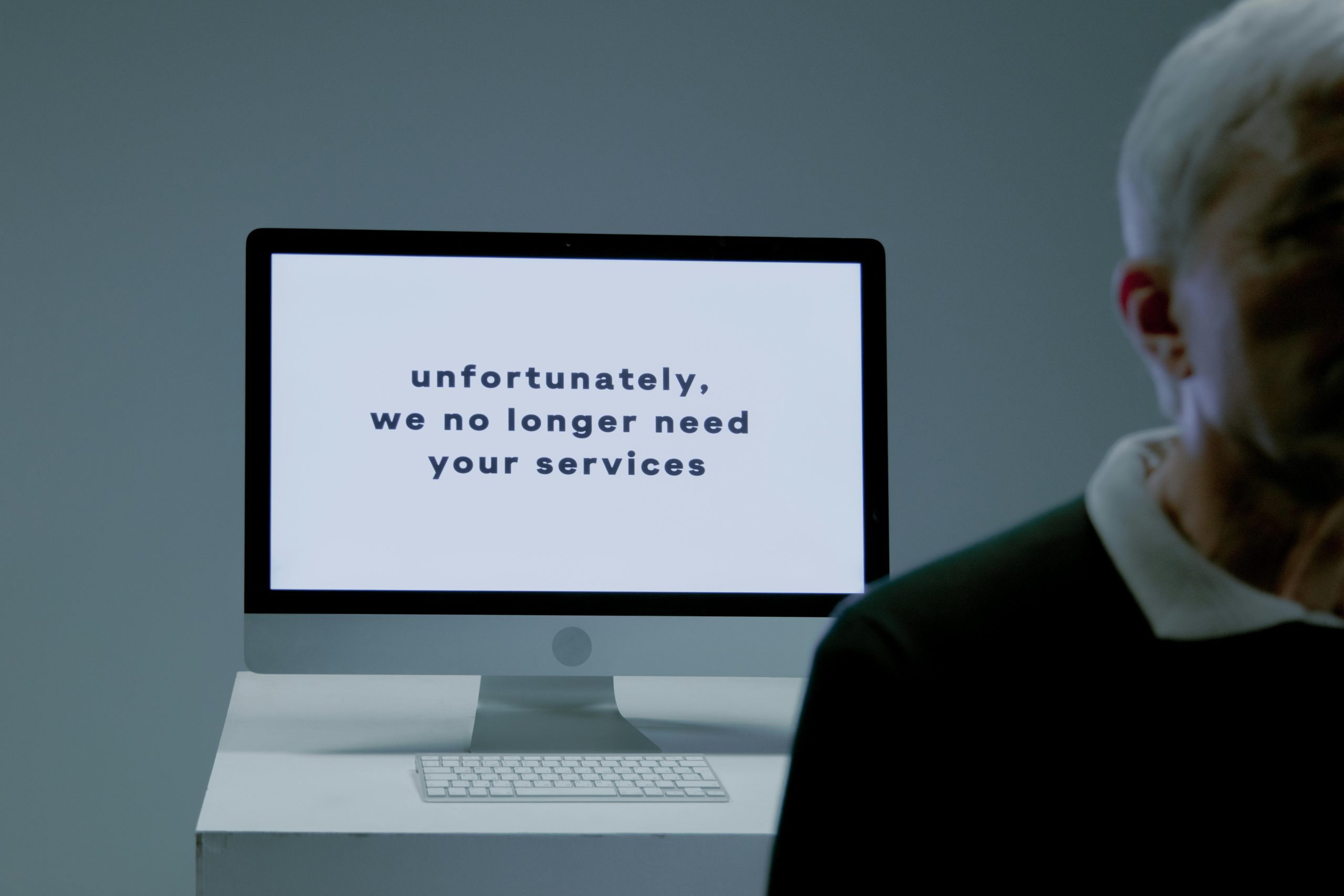

When A Dream Home Collides With Job Uncertainty

A reader wrote with a gut twisting scenario. They toured an open house on Saturday, got pre-approved and wrote an offer on Sunday, learned on Monday that the offer was accepted, and today, just 2 days later, learned their employer is planning a significant layoff of employees. Their position may be vulnerable and they are terrified. They have not even deposited earnest money yet. If this sounds like you, I want you to hear this first. You are not alone. You are not a failure. You are facing a real life curveball and it is okay to change course.

The Compassionate Answer First

If your employment is at risk and you cannot afford the mortgage on one or no income income, the healthiest decision is to step back from this purchase. Housing should give you stability and breathing room. A new mortgage that you cannot confidently support will do the opposite. There will be other homes. There is only one you. Protect your peace and your finances.

What To Do Today

- Tell your real estate agent immediately. Ask them to review your contract for the timelines and contingencies that can release you without penalty.

- Call your lender the same day. Explain the situation candidly. Lenders must verify employment before closing. A pending layoff or material uncertainty normally means they cannot approve the loan. Ask if the lender can issue a written denial or a letter stating that credit terms are no longer met.

- Press pause on paying earnest money until you receive clear guidance from your agent and lender about the cleanest exit available under your contract.

How Financing Contingencies Usually Help

Most purchase agreements include a financing contingency. It gives you the right to cancel and recover earnest money if you are unable to obtain the loan despite good faith efforts. A lender letter that you no longer qualify because of job uncertainty or job loss often satisfies that condition. Your agent will prepare a cancellation under the financing contingency and attach the lender notice. Timing is critical. These contingencies have deadlines. Act now.

If You Do Not Have A Financing Contingency

You still have options.

• Many contracts allow cancellation during an attorney review or inspection window.

• Some allow cancellation tied to appraisal or other conditions that will not be met if the loan cannot proceed.

• Your agent can request a mutual release based on the change in circumstances and remind the listing side that a backup offer may still be in play. Most sellers prefer a quick and clean release so they can move to the next buyer.

• If needed, speak with a local real estate attorney for a focused consult. A short call can save you both money and sleep.

About A Company Layoff Letter

A note from your CFO confirming a layoff period and the risk to your position can help your lender document why the loan cannot be approved. The lender cannot and should not issue final approval when continued employment is not reasonably certain. Your real estate agent can use the lender documentation to support the earnest money release.

Give Yourself Grace And A Plan

It is normal to feel grief over the home you just won. It is also wise to choose long term stability over short term excitement. Once your job picture is clear, you can return to the market with confidence. In the meantime you have taken care of your family and avoided a stress load that can spill into every corner of life.

I Am Here To Help

If you need a calm second set of eyes on your contract and your options, reach out. I am happy to walk through your scenario and put you in touch with a vetted real estate agent and a responsive local lender in your market who can guide you step by step, whether that means exiting this deal now or reentering the market later when it feels right.